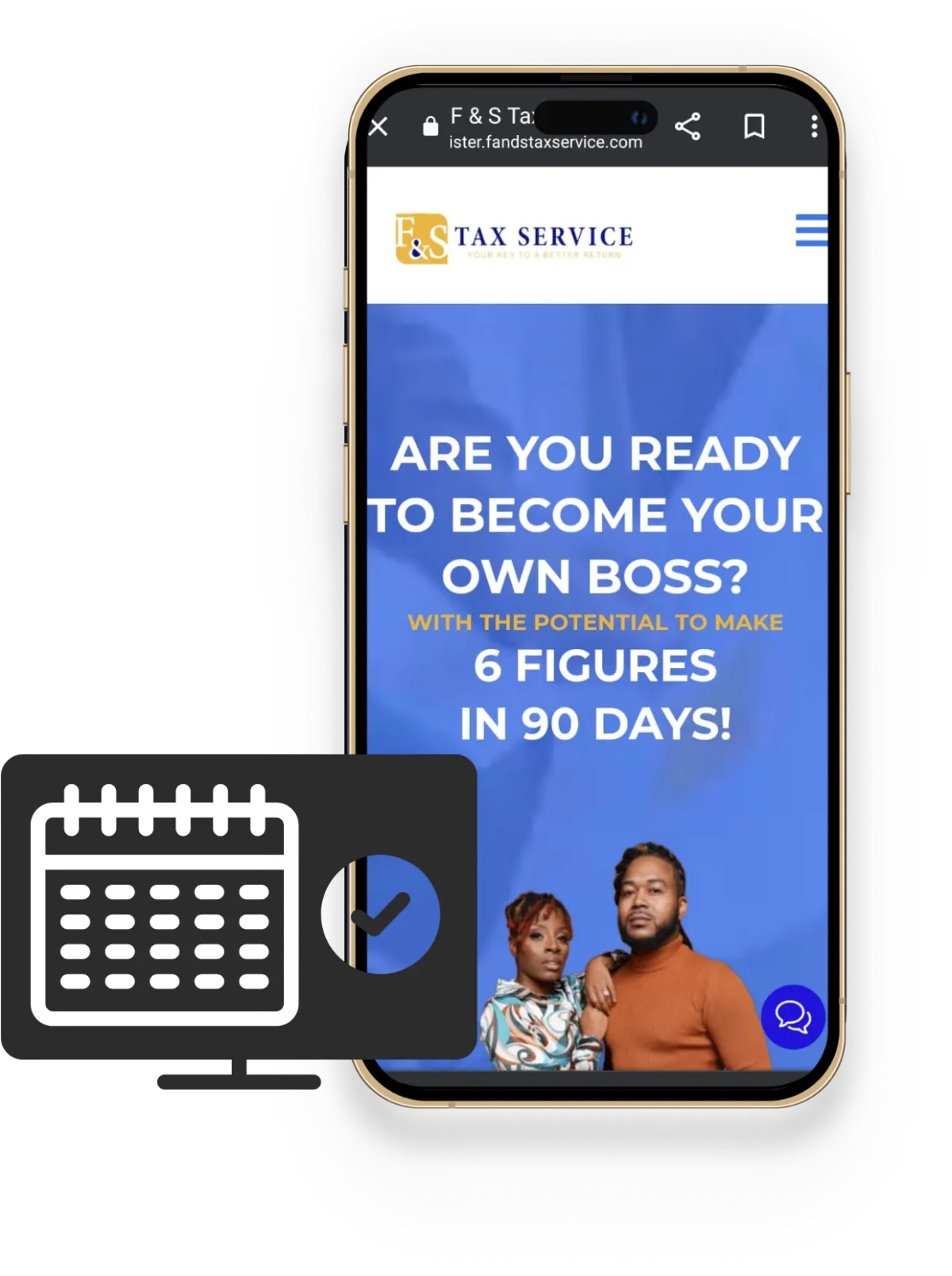

ARE YOU READY

TO BECOME YOUR OWN BOSS? WITH THE POTENTIAL TO MAKE 6 FIGURES

IN 90 DAYS!

LEARN WHAT WE HAVE TO OFFER

WATCH THE VIDEO ABOVE BEFORE CLICKING THE BUTTON BELOW

Embrace a Life of Independence and Freedom

In today's fast-paced world, many of us find ourselves trapped in the endless cycle of an eight-hour corporate workday, leaving little time for the things that truly matter. The American dream often dictates that our survival hinges on relentless daily toil to provide for our families. Yet, the harsh reality is that we either sacrifice precious moments with loved ones or struggle to make ends meet.

As Tax Professionals, we've heard this narrative from people across all walks of life. That's why we've taken a bold step to offer like-minded individuals the chance to regain control over their time without compromising their income. Our platform is designed to show you how we helped our preparers transition from earning $500 a week to a remarkable $4,000 a week, all while working just 13 weeks a year.

If you're yearning for a lifestyle change and the freedom to work on your terms, start your journey with us today!

OFFER YOUR CLIENTS

CASH ADVANCES $500-$7,000 STARTING JANUARY 3RD

AND ENTER YOUR CLIENTS IN OUR ANNUAL CAR GIVEAWAY

Step into the Future: Become Part of Our Team!

BE YOUR OWN BOSS

NO EXPERIENCE REQUIRED!

Our ideal partners should be proactive and possess strong computer literacy. It's essential to have access to a laptop, MacBook, or desktop computer. We value a strong willingness to learn and a self-driven, motivated approach.

2022 TAX SEASON TOP EARNERS

MASTER THE TAX INDUSTRY WITH F & S TAX SERVICE: NATIONWIDE EXPETISE IN TAX PREPARATION

F & S Tax Service LLC has empowered hundreds of individuals with the skills to excel in the tax industry. Our comprehensive training academy ensures you're well-prepared in the art of tax preparation, enabling you to serve clients across all 50 states with confidence.

Unlock Your Benefits as a Partner

Discover the Valuable Perks of Partnering with Us - Exclusive Training, Free Website, Automation, Marketing Support, and More!

ARE YOU READY

TO BECOME YOUR OWN BOSS? WITH THE POTENTIAL TO MAKE 6 FIGURES

IN 90 DAYS!

LEARN WHAT WE HAVE TO OFFER

WATCH THE VIDEO ABOVE BEFORE CLICKING THE BUTTON BELOW

Embrace a Life of Independence and Freedom

In today's fast-paced world, many of us find ourselves trapped in the endless cycle of an eight-hour corporate workday, leaving little time for the things that truly matter. The American dream often dictates that our survival hinges on relentless daily toil to provide for our families. Yet, the harsh reality is that we either sacrifice precious moments with loved ones or struggle to make ends meet.

As Tax Professionals, we've heard this narrative from people across all walks of life. That's why we've taken a bold step to offer like-minded individuals the chance to regain control over their time without compromising their income. Our platform is designed to show you how we helped our preparers transition from earning $500 a week to a remarkable $4,000 a week, all while working just 13 weeks a year.

If you're yearning for a lifestyle change and the freedom to work on your terms, start your journey with us today!

OFFER YOUR CLIENTS

CASH ADVANCES $500-$7,000 STARTING JANUARY 3RD

AND ENTER YOUR CLIENTS IN OUR ANNUAL CAR GIVEAWAY

Step into the Future: Become Part of Our Team!

BE YOUR OWN BOSS

NO EXPERIENCE REQUIRED!

Our ideal partners should be proactive and possess strong computer literacy. It's essential to have access to a laptop, MacBook, or desktop computer. We value a strong willingness to learn and a self-driven, motivated approach.

2022 TAX SEASON TOP EARNERS

MASTER THE TAX INDUSTRY WITH F & S TAX SERVICE: NATIONWIDE EXPETISE IN TAX PREPARATION

F & S Tax Service LLC has empowered hundreds of individuals with the skills to excel in the tax industry. Our comprehensive training academy ensures you're well-prepared in the art of tax preparation, enabling you to serve clients across all 50 states with confidImageence.

Unlock Your Benefits as a Partner

Discover the Valuable Perks of Partnering with Us - Exclusive Training, Free Website, Automation, Marketing Support, and More!

Partnering with us means gaining access to a treasure trove of benefits. From in-depth tax preparation training to cutting-edge tax software training, we equip you with the essential skills and tools to excel in the tax industry. Discover the comprehensive support that sets you up for success.

You will receive a company phone number and email, giving your virtual tax business the professional touch it deserves. Join us today and elevate your tax business to new heights.

You gain access to a wealth of benefits that include a professionally designed website and a user-friendly scheduling calendar. These essential tools will empower you to enhance your online presence, streamline client appointments, and take your virtual tax business to new heights.

As our valued partner, you'll enjoy a wealth of benefits, including FREE Marketing Materials and Dedicated Marketing Support to help you shine in the virtual tax business world.

Frequently Asked Questions

In our "FAQ" section, find answers to your most pressing questions about tax preparation, becoming a partner, and unleashing your entrepreneurial spirit. We're here to provide clarity and guidance every step of the way.

Will I be an employee of the company?

By joining our program, you will be a self-contractor working under F & S Tax Service as your own business.

How would I get clients?

You will be responsible for getting clientele. Although, we will give you the tools needed to market for new clients. Our virtual assistance is available Monday through Friday from 11am to 7pm central time. They will create marketing material for you between those hours as needed and train you on how to market your virtual tax platform.

How would I get paid?

Our company pays each contractor weekly as your clients refunds payout. Payroll is on Friday of each week and will be issued by direct deposit.

After I sign my contracts what's next?

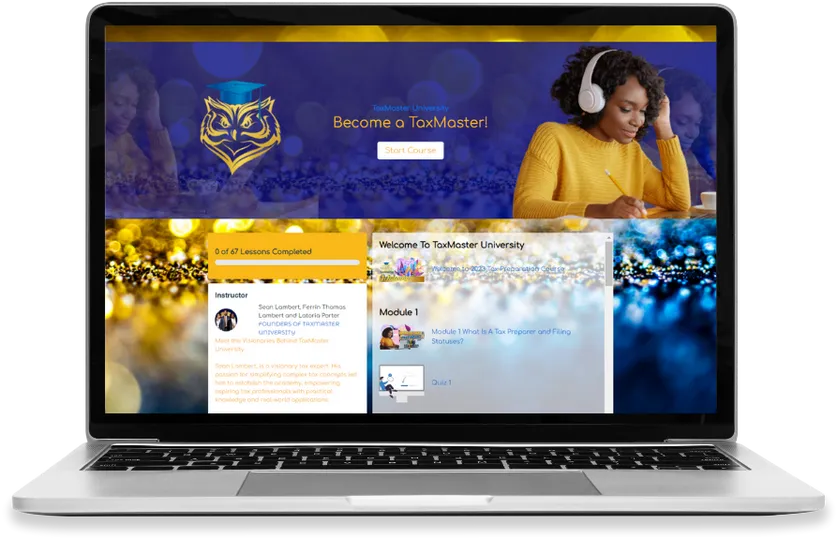

After you have completed both contracts, you would first be prompted to join our social learning group where we house tons of resources to assist you with running your virtual tax business. Secondly, you would receive an email and text message with the link to our training academy.

How can I make a years salary in 90 days?

The peak of tax season lasts about 12-13 weeks. The goal is for all tax preparers to prepare at least 10 tax returns per week. So, let's say you prepare 10 returns, and your tax preparation fee is $400 per tax return filed. That would bring your total weekly income to $4,000 weekly. Now let's times that total by 13 weeks. The total overall income for peak season would be $52,000. So, when we say a year's salary within 90 days, we say this because the average American earns up to or less than $52,000 yearly.

What steps need to be completed before I start to make money?

*First step, Watch the Explainer Video above.

*Second, Click the "Get Started Here Button" below the video.

*Third, apply for your PTIN via the IRS by following the link provided.

*Fourth, Sign The independent Contractor Agreement.

*Fifth, signed the Antifraud Agreement.

*Sixth, Join the social learning group.

*Seventh, Check your text message and email for the link to the Training Academy.

*Eighth, Complete the training academy.

*Ninth, Receive credentials after Training completion.

*Tenth, Market for new clients and prepare their tax returns.

Let's Connect

Connect with us for personalized assistance, partnership inquiries, or any questions. We're here to help you take the first step towards a successful virtual tax business.

F & S Tax Service is a leading organization on tax preparation and other related matters. We offer individuals the opportunity to prepare taxes with No Up-Front cost to you. There's no need for a brick-and-mortar building. Our platform is built for you to work 100% Virtually.

Navigation

© 2025 F and S Tax Service LLC - All Rights Reserved.